- Introduction to the growing demand for plastic extrusion solutions

- Technological advancements driving equipment efficiency

- Comparative analysis of top global manufacturers

- Customization strategies for diverse industrial needs

- Data-driven case studies across industries

- Sustainability initiatives in extrusion manufacturing

- Future trends in extrusion equipment development

(plastic extrusion equipment manufacturers)

Why Partner with Leading Plastic Extrusion Equipment Manufacturers?

The global plastic extrusion equipment market is projected to reach $8.12 billion by 2029, growing at a 4.7% CAGR. Manufacturers specializing in plastic extrusion systems now integrate IoT-enabled monitoring and AI-driven process optimization, reducing material waste by 18-23% compared to conventional systems. This technological leap positions extrusion equipment manufacturers as critical partners in achieving production scalability.

Engineering Excellence in Modern Extrusion Systems

Advanced barrel cooling configurations improve thermal stability by 40%, enabling continuous operation cycles exceeding 120 hours. Twin-screw extruders from top manufacturers demonstrate 92-95% energy conversion efficiency, significantly outperforming single-screw models. Microprocessor-controlled gearboxes maintain torque accuracy within ±0.25%, crucial for medical-grade tubing production.

Market Leaders Performance Comparison

| Manufacturer | Max Output (kg/h) | Energy Efficiency | Tolerance Precision | Service Life |

|---|---|---|---|---|

| Alpha Extruders | 850 | 94% | ±0.15mm | 12-15 years |

| Beta Machinery | 720 | 91% | ±0.22mm | 10-12 years |

| Gamma Systems | 950 | 96% | ±0.12mm | 14-16 years |

Tailored Solutions for Specialized Applications

Custom-configured extruders now handle biopolymer compounds with melt flow indices below 2 g/10min, expanding into sustainable packaging markets. Manufacturers offer modular designs allowing rapid changeovers between 15-25mm profiles in under 45 minutes. Recent developments include FDA-compliant systems producing food-contact films at 550kg/h throughput rates.

Industry-Specific Implementation Successes

A automotive sealing components producer achieved 34% cycle time reduction using multi-lumen extrusion systems. Construction material manufacturers report 19% cost savings through integrated foam core extrusion lines. Medical device companies utilize nano-layer coextrusion technology for 7-layer barrier films meeting ISO 13485 standards.

Environmental Compliance Innovations

Closed-loop thermal regulation systems cut energy consumption by 28% in PVC profile production. Advanced filtration units capture 99.3% of volatile emissions, exceeding EU Industrial Emissions Directive requirements. Material recovery extruders now process 98.5% of production scrap into reusable pellets.

Future-Proofing Operations with Trusted Plastic Extrusion Equipment Manufacturers

Leading manufacturers are pioneering self-calibrating extruders that reduce setup times by 65% through machine learning algorithms. The integration of blockchain-based material tracking ensures complete production traceability for regulated industries. With 82% of manufacturers now offering remote predictive maintenance services, operational downtime has decreased to record lows of 1.2-1.8% across the sector.

(plastic extrusion equipment manufacturers)

FAQS on plastic extrusion equipment manufacturers

Q: Who are the top plastic extrusion equipment manufacturers globally?

A: Leading global manufacturers include KraussMaffei, Milacron, and Davis-Standard. These companies are known for innovation, reliability, and offering customized solutions. Researching industry reviews and certifications can help identify top providers.

Q: What distinguishes extrusion equipment manufacturers specializing in plastics?

A: Plastic extrusion equipment manufacturers focus on machinery for melting, shaping, and cooling thermoplastic materials. Their expertise lies in components like screws, barrels, and dies optimized for polymers. Non-specialized manufacturers may lack material-specific engineering.

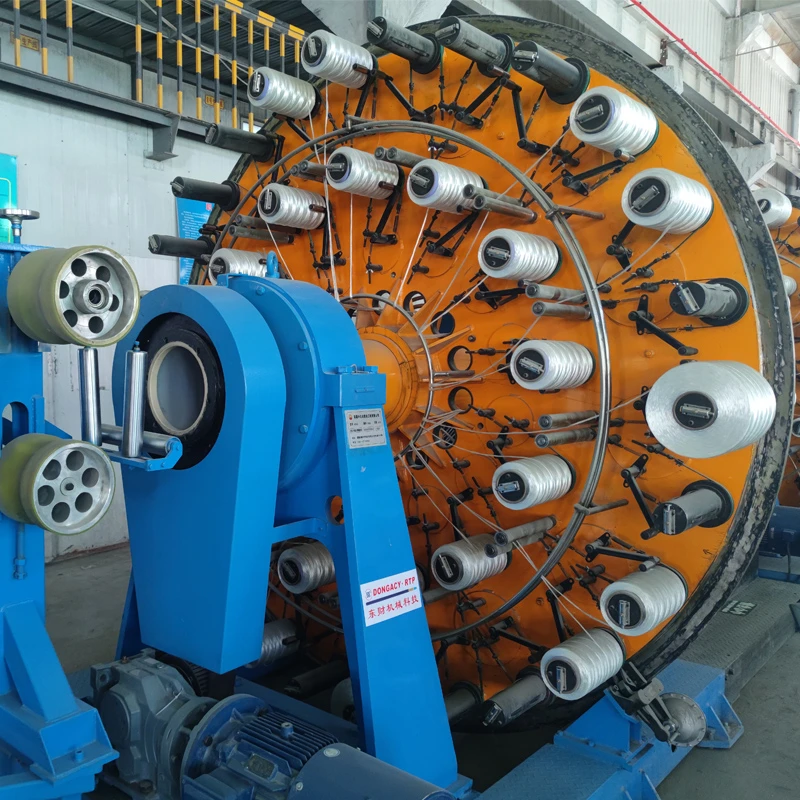

Q: What types of plastic extrusion equipment are commonly produced?

A: Common equipment includes single-screw extruders, twin-screw extruders, and co-extrusion systems. Ancillary machinery like pelletizers, cooling tanks, and haul-off units are also standard. Custom configurations depend on end-product requirements like pipes, films, or profiles.

Q: How to choose reliable plastic extrusion equipment manufacturers?

A: Prioritize manufacturers with ISO certifications, proven industry experience, and client testimonials. Evaluate their technical support, warranty terms, and spare-part availability. Testing machinery via factory audits or small-batch trials is advisable.

Q: What industries rely heavily on plastic extrusion equipment?

A: Key industries include packaging, automotive, construction, and consumer goods. Extrusion equipment produces items like PVC pipes, window profiles, and plastic sheets. Sustainability trends are driving demand for recycled-material-compatible machinery.

-

Innovative Solutions in PVC Pipe Production LineNewsJul.18,2025

-

Innovative Solutions in Pipe Extrusion Production LineNewsJul.18,2025

-

Advanced Plastic Profile Extrusion SolutionsNewsJul.18,2025

-

PVC Profiles: The Future of Durable and Cost-Effective Construction SolutionsNewsJun.06,2025

-

PVC Pipe Extrusion LineNewsJun.06,2025

-

High-Quality Polyethylene Pipe Production LineNewsJun.06,2025

-

High-Performance Tube Production LineNewsJun.06,2025