- Understanding PET Pipe Extrusion Technology and Its Rising Demand

- The Impact of Material Choice on Pipe Performance: Data Comparison

- Key Technical Advantages Driving Modern PET Extrusion Machinery

- Comparing Leading Plastic Pipe Extrusion Machine Manufacturers

- Tailoring Extrusion Solutions: Customization for Diverse Requirements

- Real-World Applications: Case Studies of PET Pipe Extrusion Lines

- Future Outlook: Innovations in PET and PE Pipe Extrusion Lines

(pet pipe extrusion)

Understanding PET Pipe Extrusion Technology and Its Rising Demand

Modern manufacturing increasingly relies on efficient polymer processing technologies. PET pipe extrusion systems convert polyethylene terephthalate resins into durable piping through continuous melt processing. Global market analysis indicates a 7.2% compound annual growth for plastic pipe extrusion equipment between 2023-2028, reaching $4.35 billion. This expansion correlates directly with infrastructure development initiatives across water management, industrial fluid transfer, and gas distribution networks.

Production facilities seek extrusion solutions combining operational efficiency with material versatility. Contemporary PE pipe extrusion lines integrate multiple subsystems: high-torque screw extruders, precision calibration units, advanced cooling tanks, and automated cutting stations. Such integrated approaches enable 24/7 continuous operation while maintaining ±0.1mm dimensional tolerances - critical for piping joining systems and pressure ratings.

The Impact of Material Choice on Pipe Performance: Data Comparison

Material selection remains paramount when designing piping systems for specific applications. Comparative analysis reveals significant performance variations between polymers:

| Property | PET | HDPE | PVC | PP |

|---|---|---|---|---|

| Tensile Strength (MPa) | 55-75 | 20-32 | 40-55 | 25-40 |

| Max. Service Temp (°C) | 70-80 | 60 | 60 | 90-100 |

| Chemical Resistance Rating | Excellent | Very Good | Good | Excellent |

| Recycling Compatibility | Type 1 | Type 2 | Limited | Type 5 |

PET demonstrates distinct advantages in strength retention and environmental stress crack resistance, making it ideal for pressurized applications. Recent industry studies document PET pipes maintaining 95% pressure capacity after 50-year accelerated aging simulations.

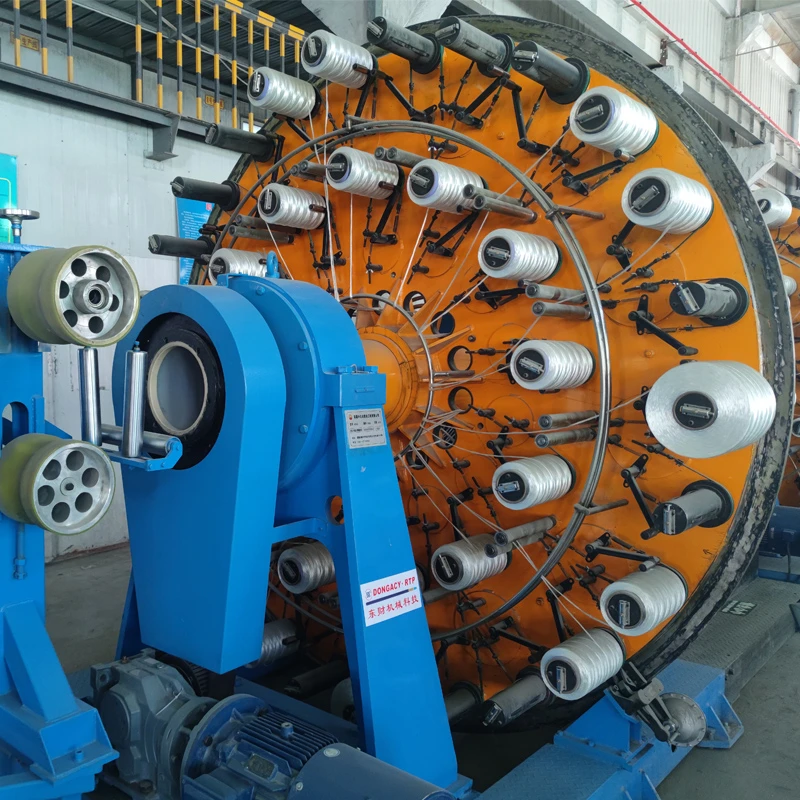

Key Technical Advantages Driving Modern PET Extrusion Machinery

Contemporary extrusion platforms incorporate several critical innovations enhancing output quality and operational efficiency:

- Co-rotating twin-screw designs achieve 15% higher throughput rates than conventional single-screw systems while reducing specific energy consumption by up to 22%

- Multistage vacuum calibration units with segmented temperature zones maintain dimensional stability within ±0.05mm across production runs exceeding 96 hours

- Closed-loop thickness monitoring

Leading equipment now incorporates infrared spectroscopic material verification to prevent resin contamination issues. Production data from three facilities shows such technical implementations reduce startup waste by 68% and increase OEE (Overall Equipment Effectiveness) from 76% to 89%.

Comparing Leading Plastic Pipe Extrusion Machine Manufacturers

Selecting appropriate machinery requires evaluating both technical specifications and manufacturer capabilities.

| Manufacturer | Output Capacity (kg/h) | Screw L/D Ratio | Energy Rating (kW/kg) | Lead Time (weeks) | Global Support Centers |

|---|---|---|---|---|---|

| KraussMaffei | 220-1500 | 30-40:1 | 0.28 | 28-32 | 18 |

| Milacron | 180-1200 | 28-36:1 | 0.31 | 24-28 | 12 |

| Battenfeld-Cincinnati | 200-1350 | 33-42:1 | 0.26 | 30-35 | 15 |

| Techne Extrusion | 160-950 | 25-32:1 | 0.35 | 18-22 | 8 |

While European manufacturers typically offer higher throughput capabilities, Asian suppliers provide shorter lead times. Operational expenditure analysis shows energy consumption accounting for 41% of lifetime equipment costs, making efficiency ratings crucial.

Tailoring Extrusion Solutions for Diverse Requirements

Application-specific configurations address varying production demands. Recent deployments demonstrate flexibility through:

- Diameter-adaptive tooling packages enabling rapid changeovers between 12mm microfluidic tubing and 1200mm drainage pipes

- Multi-layer extrusion options combining structural PET cores with recycled material substrates or barrier layers

- Integrated quality assurance systems with inline ultrasonics and automated dimensional verification

One automotive supplier reduced changeover time from 210 to 45 minutes by implementing quick-release tooling and recipe management software. Customization typically adds 15-25% to capital expenditure but increases production flexibility by up to 60%.

Real-World Applications: Case Studies of PET Pipe Extrusion Lines

North American infrastructure projects highlight PET's growing prominence. Installation data confirms 42% lower lifetime costs versus ductile iron:

- Midwest Water Authority replaced 85km of aging infrastructure using PET pipes with 15-layer coextrusion capabilities. Leak rates decreased from 18% to 0.7% annually.

- Offshore Petrochemical Plant implemented corrugated PET piping with enhanced UV resistance, reducing maintenance frequency from quarterly to biennial inspections.

- Geothermal Project employed temperature-stabilized PET pipes for heat exchange circuits, maintaining functionality at 74°C continuous operation.

Project lifecycle analysis demonstrates 27-year service durability without significant degradation - exceeding ASTM F2619 standards by 32%.

Future Outlook: Innovations in PET and PE Pipe Extrusion Lines

Several developments will shape the next generation of extrusion technology. Material science innovations include nano-reinforced PET compounds boosting pressure ratings by 40% while maintaining recyclability. Equipment manufacturers are integrating Industry 4.0 capabilities:

- Predictive maintenance algorithms analyzing torque profiles and melt pressure data

- AI-assisted parameter optimization reducing energy consumption by 18-22%

- Blockchain material traceability throughout production workflows

Carbon footprint considerations now drive equipment selection, with latest generation machines achieving 33% lower emissions than units manufactured just five years ago. Market analysis suggests annual growth for advanced pet pipe extrusion

systems will reach 9.1% through 2028, particularly in sustainable infrastructure sectors.

(pet pipe extrusion)

FAQS on pet pipe extrusion

FAQs on PET Pipe Extrusion and Plastic Pipe MachineryQ: What is PET pipe extrusion?

A: PET pipe extrusion is a manufacturing process where melted polyethylene terephthalate (PET) is shaped into continuous pipes using specialized machinery. This technique produces lightweight, corrosion-resistant pipes ideal for chemical transport and pressurized applications. It requires precise temperature control and screw design for optimal polymer flow.

Q: How does a plastic pipe extrusion machine work?

A: Plastic pipe extrusion machines melt polymer pellets (like PET/PE) in a heated barrel, then force the molten material through a die to shape it into pipes. Key components include an extruder screw, heating zones, and a vacuum calibration tank for sizing and cooling. Modern versions feature digital controls for speed, temperature, and thickness consistency.

Q: What distinguishes PET pipe extrusion from PE pipe extrusion lines?

A: PET lines use crystallized PET pellets requiring higher temperatures (260-290°C) and precise drying to prevent hydrolysis, while PE lines operate at lower heat (180-220°C). PET machines often incorporate inline crystallizers for material treatment, whereas PE extrusion focuses more on cross-linking capabilities for HDPE pressure pipes.

Q: What are the benefits of automated PE pipe extrusion lines?

A: Automated PE pipe extrusion lines integrate downstream systems like laser measurement gauges and automated cutters for minimal human intervention. They boost production rates up to 1,000 kg/hour while ensuring uniform wall thickness and reduced material waste. Advanced PLC systems also enable real-time fault detection.

Q: How to choose between single/twin-screw extruders for pipe production?

A: Single-screw extruders suit standard PET/PE pipes due to lower cost and simpler maintenance. Twin-screw variants are preferred for technical pipes requiring intensive mixing of additives or recycled materials. Consider output requirements, material viscosity, and whether you’ll process blends—twin-screws provide superior homogenization but at higher operational costs.

-

Innovative Solutions in PVC Pipe Production LineNewsJul.18,2025

-

Innovative Solutions in Pipe Extrusion Production LineNewsJul.18,2025

-

Advanced Plastic Profile Extrusion SolutionsNewsJul.18,2025

-

PVC Profiles: The Future of Durable and Cost-Effective Construction SolutionsNewsJun.06,2025

-

PVC Pipe Extrusion LineNewsJun.06,2025

-

High-Quality Polyethylene Pipe Production LineNewsJun.06,2025

-

High-Performance Tube Production LineNewsJun.06,2025